Shares of MRF, the leading tyre manufacturer in India, hit a new 52-week high of Rs 100,300 on the BSE on Tuesday. This makes MRF the first stock on Dalal Street to cross the Rs 1 lakh mark.

MRF shares have been on a tear in recent months, rising more than 20% since the beginning of the year. The company's strong performance has been driven by robust demand for tyres in India and overseas.

In the domestic market, MRF is the market leader in both passenger and commercial vehicle tyres. The company has also been expanding its international footprint, with a strong presence in markets such as South Africa, Sri Lanka, and Bangladesh.

MRF's strong performance has been reflected in its financial results. In the financial year ended March 2023, the company reported a net profit of Rs 10,235 crore, up 18% from the previous year. Revenue for the year also rose 18% to Rs 42,522 crore.

The company's strong financial performance has helped it to maintain a healthy dividend payout ratio of over 70%. In the financial year ended March 2023, MRF paid a dividend of Rs 75 per share.

MRF's strong performance is likely to continue in the coming quarters. The company is well-positioned to benefit from the growth in the Indian economy and the rising demand for tyres in both domestic and international markets.

About MRF

MRF is a leading tyre manufacturer in India. The company was founded in 1949 by K. M. Mammen Mappillai. MRF is headquartered in Chennai, Tamil Nadu. The company has a manufacturing presence in India, Sri Lanka, and South Africa. MRF's products are sold in over 60 countries.

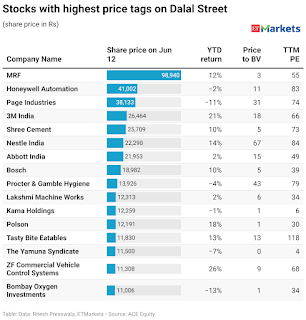

Stocks with highest price tags on Dalal Street

Key Highlights

- MRF shares hit a new 52-week high of Rs 100,300 on the BSE on Tuesday.

- This makes MRF the first stock on Dalal Street to cross the Rs 1 lakh mark.

- MRF shares have been on a tear in recent months, rising more than 20% since the beginning of the year.

- The company's strong performance has been driven by robust demand for tyres in India and overseas.

- In the domestic market, MRF is the market leader in both passenger and commercial vehicle tyres.

- The company has also been expanding its international footprint, with a strong presence in markets such as South Africa, Sri Lanka, and Bangladesh.

- MRF's strong performance has been reflected in its financial results. In the financial year ended March 2023, the company reported a net profit of Rs 10,235 crore, up 18% from the previous year.

- Revenue for the year also rose 18% to Rs 42,522 crore.

- The company's strong financial performance has helped it to maintain a healthy dividend payout ratio of over 70%. In the financial year ended March 2023, MRF paid a dividend of Rs 75 per share.

- MRF's strong performance is likely to continue in the coming quarters. The company is well-positioned to benefit from the growth in the Indian economy and the rising demand for tyres in both domestic and international markets.

Comments

Post a Comment